Exactly how to Make the most of the Advantages of a Secured Credit Card Singapore for Financial Development

Exactly how to Make the most of the Advantages of a Secured Credit Card Singapore for Financial Development

Blog Article

Unveiling the Opportunity: Can People Released From Bankruptcy Acquire Credit Report Cards?

Comprehending the Effect of Insolvency

Upon declaring for bankruptcy, people are challenged with the considerable consequences that penetrate numerous elements of their monetary lives. Personal bankruptcy can have a profound influence on one's credit report, making it testing to gain access to debt or financings in the future. This monetary stain can stick around on credit rating reports for a number of years, impacting the person's capability to secure favorable rates of interest or financial opportunities. In addition, insolvency may cause the loss of possessions, as certain possessions may require to be liquidated to repay financial institutions. The psychological toll of bankruptcy need to not be undervalued, as individuals might experience feelings of pity, stress, and sense of guilt as a result of their monetary scenario.

In addition, insolvency can restrict work possibilities, as some employers conduct credit checks as part of the working with process. This can pose an obstacle to people looking for new task leads or profession advancements. Generally, the impact of bankruptcy prolongs past financial constraints, influencing different aspects of an individual's life.

Aspects Impacting Bank Card Authorization

Acquiring a charge card post-bankruptcy is contingent upon various key factors that significantly affect the authorization process. One important element is the candidate's debt rating. Complying with bankruptcy, individuals often have a reduced credit history because of the negative influence of the personal bankruptcy filing. Credit report card business generally search for a credit history that demonstrates the candidate's capability to manage credit sensibly. One more important consideration is the candidate's revenue. A secure earnings guarantees credit report card issuers of the individual's ability to make prompt payments. Additionally, the size of time given that the personal bankruptcy discharge plays an important function. The longer the period post-discharge, the a lot more favorable the possibilities of approval, as it suggests monetary stability and responsible credit scores behavior post-bankruptcy. Furthermore, the kind of bank card being obtained and the provider's particular requirements can likewise influence authorization. By very carefully taking into consideration these factors and taking actions to reconstruct credit post-bankruptcy, people can improve their leads of obtaining a bank card and working towards financial recuperation.

Actions to Rebuild Credit Report After Bankruptcy

Reconstructing credit scores after personal bankruptcy needs a tactical technique concentrated on financial self-control and regular debt administration. The very first step is to review web link your credit scores report to guarantee all financial obligations included in the personal bankruptcy are accurately reflected. It is important to establish a budget plan that prioritizes financial debt payment and living within your ways. One effective approach is to best site get a protected bank card, where you deposit a specific quantity as security to establish a credit score limit. Timely repayments on this card can show accountable credit scores usage to possible lenders. Additionally, take into consideration becoming an authorized individual on a family members member's charge card or checking out credit-builder finances to more increase your credit report. It is important to make all settlements on time, as repayment history significantly affects your debt rating. Perseverance and willpower are crucial as rebuilding credit rating requires time, but with dedication to sound monetary methods, it is possible to improve your creditworthiness post-bankruptcy.

Guaranteed Vs. Unsecured Credit Score Cards

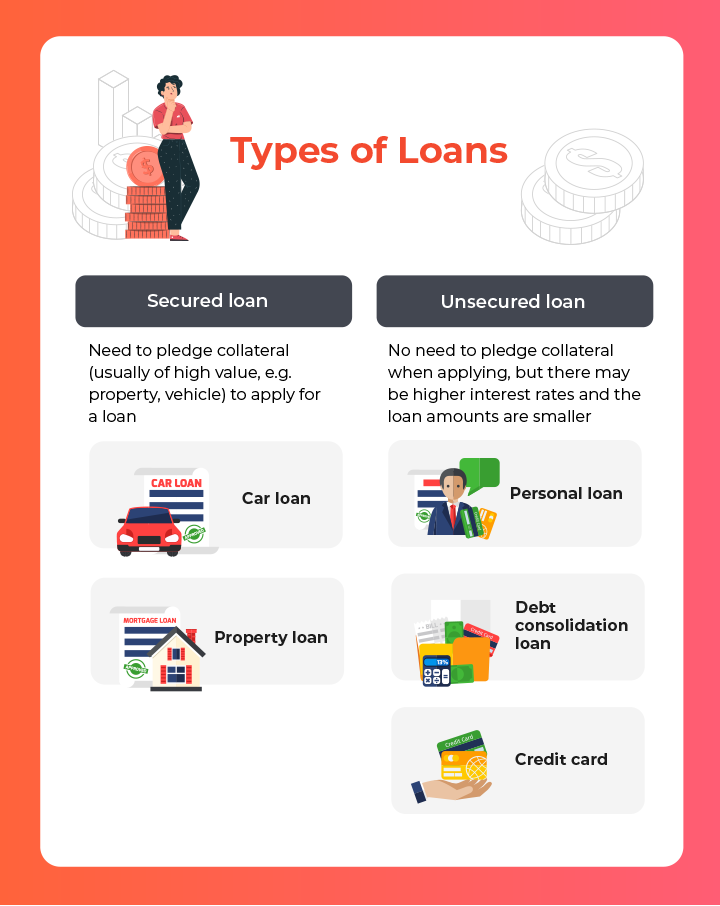

Complying with personal bankruptcy, individuals frequently think about the selection between secured and unsafe credit score cards as they intend to restore their credit reliability and economic stability. Protected debt cards require a cash deposit that offers as collateral, normally equal to the credit limit approved. Ultimately, the option in between secured and unsafe credit scores cards need to align with the individual's financial objectives and capability to manage debt sensibly.

Resources for Individuals Looking For Credit History Restoring

For individuals intending to boost their creditworthiness post-bankruptcy, discovering readily available resources is vital to effectively browsing the credit history restoring procedure. secured credit card singapore. discover this One important source for people seeking credit rating restoring is credit score counseling agencies. These organizations provide monetary education, budgeting assistance, and personalized credit rating renovation plans. By dealing with a credit report therapist, individuals can acquire insights into their debt reports, find out strategies to increase their credit rating, and receive support on handling their financial resources effectively.

Another valuable source is credit history tracking services. These services allow people to maintain a close eye on their credit rating reports, track any kind of changes or errors, and identify prospective indications of identity burglary. By monitoring their credit report routinely, people can proactively address any concerns that might emerge and make sure that their credit report details depends on day and precise.

Additionally, online devices and resources such as credit scores score simulators, budgeting applications, and economic proficiency web sites can supply individuals with beneficial details and tools to assist them in their credit score restoring journey. secured credit card singapore. By leveraging these resources successfully, individuals released from personal bankruptcy can take purposeful steps in the direction of enhancing their credit report health and wellness and protecting a far better financial future

Verdict

Finally, people released from bankruptcy might have the opportunity to acquire charge card by taking steps to reconstruct their debt. Elements such as credit report revenue, background, and debt-to-income ratio play a considerable function in credit history card authorization. By recognizing the influence of personal bankruptcy, picking in between safeguarded and unprotected bank card, and utilizing resources for credit rating rebuilding, individuals can improve their credit reliability and possibly acquire access to charge card.

By functioning with a credit scores therapist, individuals can acquire understandings into their credit records, discover strategies to improve their credit scores, and obtain guidance on handling their finances successfully. - secured credit card singapore

Report this page